Stock market

- Thread starter High kev

- Start date

Punisher84

Just some asshole

I try to stay away from those penny stocks. Anything under a buck for sure. The more I trade the more I’m shying away from the cheaper stuff. It’s quick money but that money goes both ways. I’ve traded NIO a bunch. If you chart it out it’s got support/resistance lines every .50-1.00. Pretty predictable.@Hotwired

On 7/13/'20...

I hit sold instead of the buy tag on the €/$

Locked in at .13035...

On a .13001 daily low.

.30 cent position went $2,119.50 in The Red.

I had made $179 - $257 on .20 positions 4 days straight before that horrible flubb up.

Thats 895 -1,285 points per day. If

I wasnt being a smug smart arse I would have clip the balloon right after the mistake. Sorry, ice cream on the sidewalk.

Instead I torched a 4,475 - 6,425 point week.

All because I was to over confident, arrogant, an to lazy to end the trade instead of trying to slack off on the next days low.

If you’re day trading look for base hits. Those count more than home runs. Being consistent seems to be key. Walking away from the computer is another lesson to learn. Good example was Friday I traded SOLO. Man it worked out perfectly, got out right at the top. 40 min of trading and I had made more than the rest of the week combined. Instead of walking away I fucked around and gave back half of my profits for the day thinking I could make more. Fortunately caught a good trade on XPEV and made back my losses closer to the end of the day. So I spent a 7 more hours at the desk and made the same I did in 40 minutes. Not smart.

Hotwired

~

I lost $40k for every penny it went down.$2M = $46K

or

$2M = $870 a point??

Punisher84

Just some asshole

Wife has series 3, 6 and 7 too I think, doesn’t know shit about tradingI dont like ETFs...

I like spot trades...I have been thinking about my series 3.

I dont have anything to lose by getting it.

I don’t think a license will make you any better of a trader.

I AM

Active Member

okay@hotwired...

a legit unleveraged 2M.

Fuck thats tough...

@Punisher84

damn. 3/6/7...

talk about access to the markets.

You are right...they woulnt teach you to actively chart trade.

a legit unleveraged 2M.

Fuck thats tough...

@Punisher84

damn. 3/6/7...

talk about access to the markets.

You are right...they woulnt teach you to actively chart trade.

Hotwired

~

I still watch oil cause I'm addicted but I don't trade. My account was fully closed many years ago. I just chart watch now.@Hotwired

Did you see WTI on 4/20 of this year!? I saw it...an knew it was the buy of the year an didnt have access to the market.

Then had to watch it bounce back...

in my

Now1more

Super Active Member

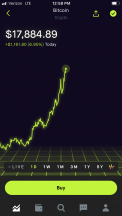

Big question is, will it push past $20k? Last time it was that close it crashed badly. My daughter and her previous boyfriend use to day trade crypto back in 2017. That's when I started to follow. The more that blockchains are adopted, the better the outlook, and I think that Covid has an impact that will promote adoption. I see a lot more people doing business with cryptocurrency.